Green tariff dispute threatens to undo Ukraine’s renewable energy sector

Latest news for today in Ukraine

Ukraine’s renewable energy sector is in danger of losing most major investors as the government considers deep cuts to its so-called green tariffs.

The energy ministry has proposed slashing the feed-in tariff for renewable power plants, saying the incentive puts major strain on the electricity market.

Industry players countered that the ministry has been unwilling to compromise and that gutting the tariff will not solve the issue.

Both sides have been negotiating for months and started mediation in late January. But the talks are on the verge of a breakdown, which could trigger an avalanche of arbitration cases against the government, experts say.

At stake is not only the strain on the state budget caused by high tariffs designed to attract investment into the renewable sector, but whether the nation will attract investment if it makes retroactive cuts that violate promises.

“They are simply destroying the sector with these proposals,” said Oleksandr Kozakevich, the head of the Ukraine Association of Renewable Energy. “No one is going to want to invest in renewable energy in Ukraine.”

Following the March 4 dismissal of Prime Minister Oleksiy Honcharuk’s cabinet, industry players are waiting to see whether the reconstituted energy ministry will compromise. The energy minister post is one of the few Cabinet positions that remains unfilled after the reshuffle.

Oleksiy Orzhel, the recently sacked energy minister, and deputy Oleksiy Chyzhyk, who has represented the government in mediation, did not respond to requests for comment.

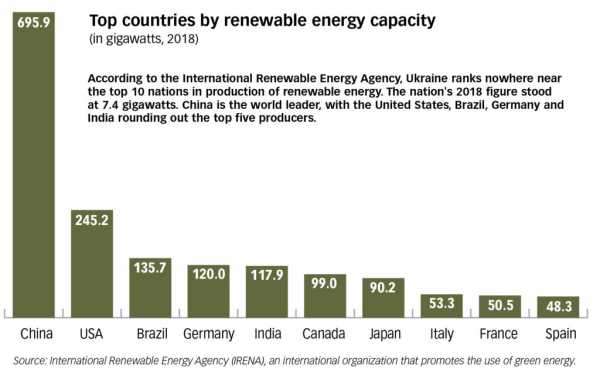

According to the International Renewable Energy Agency, Ukraine ranks nowhere near the top 10 nations in production of renewable energy. The nation’s 2018 figure stood at 7.4 gigawatts. China is the world leader, with the United States, Brazil, Germany and India rounding out the top five producers. (Source: International Renewable Energy Agency)

Growing deficit

Ukraine’s current green feed-in tariff is the highest in Europe in order to attract investment into the sector. However, it has a relatively short period, through the end of 2029.

In 2019, Ukraine passed a law to replace the tariff with renewable auctions starting in 2020. This prompted a huge surge of investors to enter the market before the end of 2019. In a public letter to the mediator, Orzhel wrote that “untimely industry regulation” and a stampede of new green projects last year “puts a significant strain on the electricity market.”

Indeed, in 2019, Ukraine added about 4.5 gigawatts of renewable capacity, nearly tripling its total output to 6.8 gigawatts, which is more than 5.5% of its total energy mix, according to the Ukrainian State Agency for Energy Efficiency and Conservation.

The Guaranteed Buyer, a state body responsible for buying renewable energy from producers, has run substantial deficits last year – a shortfall that is expect to reach Hr 19 billion, or $775 million, in 2020.

However, industry experts point out that the deficit was not caused by the high tariff but by the Guaranteed Buyer being exposed to transmission system costs in the Ukrainian grid.

While the Guaranteed Buyer’s costs were supposed to be compensated by transmission fees from grid operator Ukrenergo, last year litigation from metallurgical companies blocked raising transmission costs for nonresidential consumers. Since then, the government changed the transmission structure in an effort to protect business from growing power costs.

Oleksiy Feliv, a managing partner at the law firm Integrites, estimated that cutting the tariff would only eliminate between a fourth and a third of the pending deficit.

The European-Ukrainian Energy Association industry group said that these transmission systems obligations “have produced serious financial and operational distress, resulting in a non-bankable environment in the renewable energy sector.”

Dead end

A push for mediation over the green tariff started in the fall, but actual talks were delayed until late January. Since late November, the government’s proposals have grown ever less tenable, according to half a dozen companies that spoke to the Kyiv Post.

“The ministry keeps worsening and worsening its proposals,” said Kozakevich.

The ministry’s first proposal would see wind tariffs cut by 10%, operating solar plants’ tariffs by 17% and the tariff on solar plants to be commissioned in 2020 by 15%. Operating facilities’ tariff terms would be extended by five years.

A compromise bill introduced on Dec. 6 was had much of the industry’s support. Operational wind plants would see a 5% reduction and wind plants to be commissioned in 2020-2022 would get a 7.5% reduction. Operating solar plants’ tariffs would decrease by 10% and solar plants commissioned in 2020 by 15%. The term would run for 15 years from the date of the facility’s commissioning. This bill would also set a more gradual balancing requirement. Neither bill passed the Rada.

And on Feb. 27, the ministry unilaterally proposed an even bigger cut. Depending on their size, solar plants would take a 15-25% cut. Wind plants would also see their tariffs cut by 10%. At the same time, it offered an alternative: a voluntary single 12.5% tariff reduction for solar power projects and a 5% cut for wind.

Industry players were outraged when the latest offer was announced at the Ukraine Energy Forum, saying that the cuts were too extreme and that the ministry violated mediation confidentiality agreements.

The Ukrainian Renewable Energy Association confirmed that its counter-proposal involved a 10% tariff cut for plants up to 10 megawatts and 15% for larger projects. The reductions would apply to facilities launched since 2017. The tariff would be extended through 2034.

Alina Sviderska, head of government relations at Norwegian developer Scatec Solar, said that in January the ministry demanded another retroactive change – demanding a grid connection before a company can receive a feed-in tariff. This placed another burden on developers, as it would allow oblenergos – regional electricity suppliers – to manipulate energy prices.

Yuriy Kubrushko, who is coordinating the negotiations on behalf of the industry group, told the Kyiv Post that the proposed changes could wipe out up to 40% from renewable companies’ cash flows – if the companies are able to operate under such onerous conditions. Many won’t be able to do so.

“For us, it’s a total loss,” said Tom Hanson, founder of GreenWorx Holding, which invested 11.5 million euros in a project in Ukraine.

Folding their arms

Hanson and Sviderska said that they observed disagreements not only between government and the industry but also among government agencies.

Multiple people involved in the mediation said that the ministry appears to be unwilling to budge on tariffs because it perceives the industry as taking advantage of Ukrainian consumers. There is a sense that some companies — including Rinat Akhmetov’s DTEK, which has almost a fifth of installed green capacity — are bilking the economy and that officials are trying to stop it at the expense of the other 80% of investors.

“They’re trying to wipe out DTEK but the collateral damage is everyone else,” said the source. “And DTEK will survive.”

Ministry officials are also concerned about future balancing capacity, which industry representatives concede is a legitimate concern as long as Ukraine does nothing to update its grid. Foreign investors had previously announced their willingness to invest in balancing and grid modernization.

Consequences

If the government adopts the new lower tariff, it’s very likely that many developers and investors will turn to international arbitration to recoup their losses, according to industry negotiator Kubrushko.

“They simply will have no other choice,” he said.

Lawyer Feliv agreed, saying the likelihood of arbitration is very high, as Ukrainian law explicitly spells out its strong guarantees to renewable energy producers against retroactive changes. The wording of the current body of law leaves little room for ambiguity, the lawyer said.

“The government might say that the players understood that the tariff is too high, which is why they can’t win,” said Feliv. “But in reality, this is nonsense. If the tariff is high, it’s to stimulate investment.”

In the case of Spain, which retroactively changed its high renewable tariffs, many companies won subsequent arbitration disputes — even though Spanish law provided fewer guarantees than its Ukrainian counterpart.

However, in Ukraine’s case, it would be even worse, Feliv said. The Spanish cases concerned power plants that had already been built. In Ukraine, the state budget might be forced to compensate many projects that only exist on paper.

“And this is the worst-case scenario,” he said.

Source: www.kyivpost.com