Main points

- The band U2 has released a documentary video clip for the song Yours Eternally, filmed with the participation of fighters of the 13th Brigade of the National Guard of Ukraine “Charter”.

- The song Yours Eternally was included on U2's mini-album Days of Ash, which is the band's first new material since 2017.

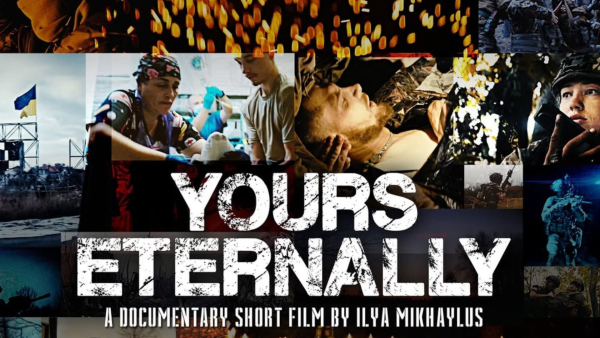

On the anniversary of the invasion, the famous band U2 released a video featuring fighters from the Charter Brigade / Photo from the U2 band's Instagram page

To mark the fourth anniversary of Russia's full-scale invasion of Ukraine, Irish band U2 has released a short documentary video for the song “Yours Eternally.” The track was recorded in collaboration with ANTIBODY and British singer Ed Sheeran.

The video for this song features fighters from the 13th Brigade of the National Guard of Ukraine “Charter”. The video clip has already been published on the U2 YouTube channel.

For example, the band U2 released a 4.5-minute short documentary inspired by the song Yours Eternally. It was directed by Ukrainian filmmaker and Charter soldier Ilya Mykhailos.

The video shows real operations of the brigade in the Lipetsk and Kupyansk directions, including footage of the wounding and evacuation of one of the officers. In addition to combat operations, viewers can see training, everyday life and leisure activities of the Ukrainian military.

The film was shot in the winter of 2025, when Mykhailos and his team were stationed with the 13th Brigade of the National Guard of Ukraine “Charter” in Ukraine. It shows the extraordinary everyday life of Alina and her fellow soldiers fighting on the front lines of the war,

– the musicians noted on their Instagram page.

U2 – Yours Eternally ft. Ed Sheeran and Taras Topolia: watch the video online

It should be added that the song Yours Eternally was included in U2's mini-album called Days of Ash, which consists of six songs, where the musicians react to full-scale wars, killings of civilian protesters and rallies in Iran, as noted by The Guardian. Days of Ash is the first new musical material from U2 since the album Songs of Experience, which was released in 2017.

What is known about U2?

- This Irish band was founded back in 1976.

- The band consists of frontman Bono (real name Paul David Hewson), guitarist The Edge (David Howell Evans), bassist Adam Clayton, and drummer Larry Mullen Jr.

- The artists have been openly supporting Ukraine since the start of the full-scale war. In May 2022, they came to Kyiv at the invitation of Volodymyr Zelensky and performed in the capital's metro.

- In addition, in 2024, during a concert in Las Vegas, Bono called on the United States to continue helping Ukraine, and in May 2025, at the Cannes Film Festival, the U2 frontman met with Ukrainian bandurist and military serviceman Taras Stoyar – together they sang the song The One.